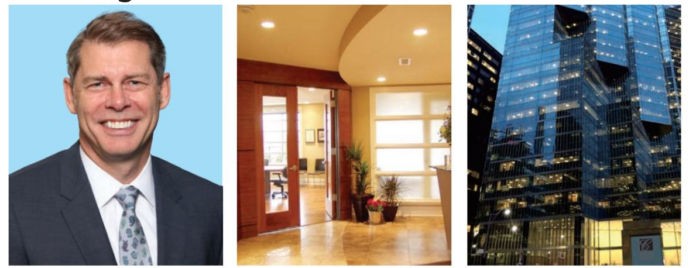

Chris Coderre – Portfolio Manager,

Vice President & Investment

Advisor at Caldwell Securities Ltd.

Over the years, Investment Advisor, Chris Coderre has dealt with many situations involving individuals, families and trusts who are in a position to come into newly found wealth. These tend to fall into several categories; selling a business, selling a house or property, or receiving an inheritance.

Most people are not prepared for how to navigate through these changes in their financial circumstances.

Some want to do a financial review to determine if they have enough to retire. Another common situation is succession planning – Can we? How do we invest to live off of the income, so we can leave the money to our children? Still others are not happy with their current Advisor or firm. The family often wants a private meeting with a firm that is both experienced and dedicated to helping them understand how and why they are invested. Perspective spent time with Chris for a down to earth Question & Answer:

Q How would you describe your practice?

A. The Oakville practice enjoys the best of the local presence, coupled with a Toronto head office team of Analysts, Portfolio Managers and our own back office. Our practice includes Financial Strategies (financial review and insurance), Protecting Your Legacy (executor consultation, legacy plan review), as well as a very experienced Investment Management component. We create a personalized investment strategy for each client tailored to their personal needs.

Q. With regards to investing, what is the most common question on people’s minds as of late?

A. By far the biggest concern in this environment of trade wars and the fear of recession is “How can I protect my capital and still make a decent return?” This inevitably leads to a discussion about various income strategies that attempt to have a low correlation to the stock and bond markets.

Q. What differentiates your Wealth Management practice from others in the industry?

A. Our solutions are not limited to pre-packaged model portfolios or in-house funds. We are aware of less expensive “Do-It-Yourself ” options. In my view, we offer a strong wealth management practice that takes into account all of our client’s family needs combined with strong investment management capabilities. We take a holistic approach to servicing our client’s accounts, by making sure their investment objectives, financial strategies and desired legacy plans are aligned.

Q. In your opinion, how has the wealth management industry changed over the last few years?

A. Today’s asset management industry is experiencing increased competition, greater regulatory change, and evolving customer demographics and needs. There are now more choices than ever for clients. Full service wealth management is almost entirely fee based now.

Q. How can people learn more about the services you provide?

A.Our Oakville team hosts regular educational seminars on topics such as Health, Wealth & Legacy, Investing in a Low Interest Rate Environment and Executor Liability. Please contact our office if you are interested in attending an upcoming seminar or would like to book a complimentary consultation.

Investing involves uncertainty and risk that you may not recoup the amount originally invested. Caldwell Securities Ltd. (Caldwell) makes no representations, warranty or guarantee of investment performance. Caldwell is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and is a member of the Canadian Investor Protection Fund (CIPF). Caldwell Securities Ltd. and Caldwell Investment Management Ltd. are wholly owned subsidiaries of Caldwell Financial Ltd.